As nearly four months have passed since the landfall of Hurricanes Milton and Helene, Florida residents and investors are looking for the next step in their action plan. These hurricanes made a direct impact on the real estate market, resulting in damaged homes, decrease in prices, and curious investors. In towns hit harder than others, like Ana Maria Island or Clearwater Beach, homeowners are looking to get rid of their damage-prone properties by listing them at low prices and hoping to relocate. While these damaged homes and low prices steer many away, wary about the potential for future damage, others flock to the area looking for potential investment opportunities.

The big question among investors is, “Should I invest in a hurricane damaged home in Florida?”. For some, the answer is a clear no. But for others, the promise of the sunshine state of mind is enough to foster hope in the longevity of Florida’s coastal real estate market.

Why are Hurricane Damaged Homes for Sale?

With that being said, investing in a hurricane damaged home is a double-edged sword; there are both significant risks and potential benefits. Whether or not you should invest in a hurricane damaged home in Florida relies heavily on what kind of project you’re willing to take on. If you’re looking for a turnkey property, this investment journey is probably not the one for you. Investing in one of these homes can pose significant challenges and require time, work, and a ton of expenses. However, those who can foot the bill for large renovations, demolitions, and full rebuilds, may have the ability to see a high return on investment.

The most attractive quality of a hurricane damaged home is its low purchase price. While these lower prices create an opportunity to purchase a property below market value, doing so will come with a handful of other expenses and risks. Investors must be wary of why a hurricane damaged home is on the market for such a discounted price.

Some severely damaged homes are salvageable, and others are not. Following a hurricane, you will find both categories of homes for sale — this is where due diligence comes into play. As an investor, it is crucial that you do your research to understand the condition of the home you’re buying. While some homes for sale can be redone, it’s likely that some require a full demolition and rebuild.

In most cases, these homes are for sale because of the substantial amount of work required to acquire permits and meet building codes and FEMA regulations. Here are some essential aspects to consider when deciding whether or not to invest in a hurricane damaged home:

Property Condition and Damage

Prior to purchasing one of these properties, it is essential that you look into FEMA assessments that determine the property condition and amount of damage. When dealing with hurricane damaged homes, property listings often lack transparency. As many homeowners just want to get rid of these properties, some of these listings are vague and lack essential information, conveying messages like “Fixer-upper” or “Potential for a home flip”. In reality, the damage may call for more than a simple renovation and fixing up.

According to Fox 13, one property investor was caught off guard when FEMA deemed his investment property substantially damaged, calling for demolition, relocation, and elevation. Being that this notice was issued after the buying process had begun, he was unaware of the severity of the property condition and the investment transaction was cancelled.

Purchasing a hurricane damaged property differs from a typical property investment in that excessive research and due diligence is necessary. While investors should always research their potential purchases, hurricane damaged homes often have extra layers to reveal. Not only is it necessary to contact FEMA and check public records, but it is essential to recognize the regulations that must be met for rebuilding a home in a hurricane zone.

Florida Building Code Hurricane Zone Regulations

Homes built in Florida, especially those in hurricane and high wind zones, must meet strict Florida Building Code requirements.

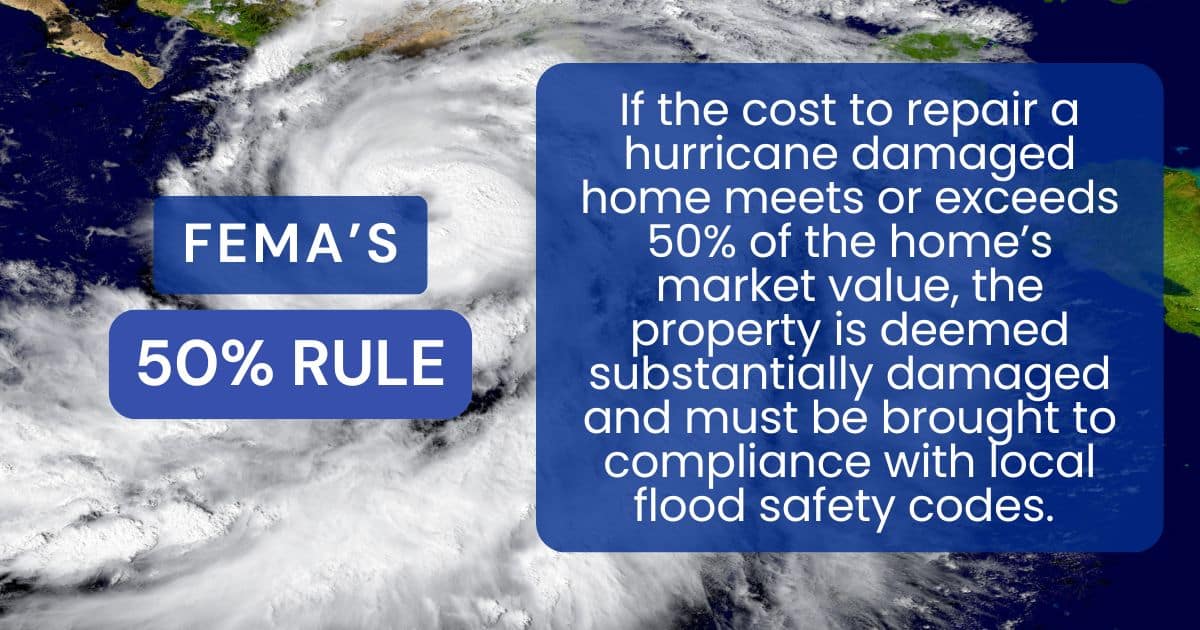

In addition, all investors should be aware of FEMA’s 50% Rule. This rule states that if the cost to repair a hurricane damaged home meets or exceeds 50% of the home’s market value, the property is deemed substantially damaged. Being that substantially damaged homes must be brought to compliance with local flood safety standards, this rule should not be taken lightly. These requirements have the potential to severely alter your renovation and reconstruction plans if not taken into account accordingly.

Properties requiring demolition and reconstruction are required to be constructed in accordance with Florida’s strict building code requirements. Building code requirements vary depending on location throughout the state, however these codes regulate building aspects such as:

- Structural Design: foundation, roofs, walls, materials

- Hurricane and wind resistance: windows, doors, and roofing materials

- Floodplain management

- Fire safety

- HVAC, insulation, lighting systems

- Electrical systems

- Plumbing

- Inspections and permits

In addition, some cities have a look-back period. For example, a look-back period of 5 years would mean that if all work over the course of 5 years meets or exceeds 50% of the market value, the home must be brought to compliance with local flood safety standards. If previous owners did not follow compliance and obtain the necessary permits for construction within the look-back period, these construction costs will accumulate and carry over upon the purchase of the property.

Look-back periods can be the difference in being able to repair a hurricane damaged home. Even if the home is repairable without demolition, the look-back period and 50% rule can prohibit investors from making repairs without fully altering the home to bring it to compliance.

Potential For Future Damage:

It goes without saying that purchasing a property in a hurricane flood zone is a risk. If the property has been damaged once, it has the potential to be damaged again. While there are preventative measures to take in reconstructing the property, the threat of natural disasters are ever present in Florida’s coastal neighborhoods, and the severity of these storms are extremely unpredictable.

To speak to the unpredictability of Florida hurricanes, I can recount experiences of my own. As a four year Tampa resident, I’ve faced evacuation orders four times. Whether it’s the tale of “supernatural forces”, or just pure luck, Tampa dodged severe hurricane damage for three of these instances. While this statement does not remain true for the 2024 hurricane season, Tampa has a history of coming out unscathed from major hurricane damage.

When purchasing a hurricane damaged property, it is crucial to evaluate the flood zone and history of hurricane damage to ensure you know what potential damage your property can face.

Insurance Considerations for Residential Properties:

When investing in a hurricane damaged home, it is essential to evaluate and consider insurance requirements and potential challenges. A standard homeowners insurance policy typically does not cover hurricane and flood damage. Obtaining protection from hurricane-related damage will require additional insurance premiums and come at higher costs. It is imperative to perform an in-depth evaluation of insurance plans and deductibles to ensure you have necessary coverage in the event of another hurricane or storm.

To put the importance of insurance into perspective, according to the Catastrophe Claims Data and Reporting after Hurricane Milton:

- Number of claims reported: 264,763

- 22,668 open claims with payment

- 20,347 open claims without payment

- 116,959 claims closed with payment

- 104,789 claims closed without payment

- Total incurred loss: $2,655,780,072

- Claims closed without payment due to non-covered flood damage: 4,264

- Claims closed without payment due to damage below deductible: 45,725

Hurricane Damaged Home Investment Overview

The number one thing to keep in mind when purchasing a hurricane damaged home: don’t be fooled by the low listing price. While the initial purchase price of a hurricane damaged home may be significantly lower than the typical value of that home, it typically comes at the cost of many high expenses and risks.

However, a hurricane damaged home can be a profitable investment if you are aware of the possible obstacles and financial responsibilities of doing so. While the risks are significant, investing in a hurricane damaged home also offers the possibility of:

- High return on investment

- Home customization

- High rental demand

- Reduced competition in the market

- Potential for short-term and long-term gains

So, to answer the question of whether or not you should invest in a hurricane damaged home in Florida, the answer is that it really depends. Prior to purchasing a hurricane damaged home, investors must do their due diligence to ensure a full understanding of the property condition, insurance considerations, building code regulations, and potential for future damage.

As a Tampa property manager, I can tell you that dealing with hurricane and storm damage can come at an extremely high cost. The price of repairing, insuring, and owning a hurricane prone property can extend far beyond the initial purchase price. However, those willing and able to dedicate the time and resources to do so have the opportunity to benefit from the potential of significant profits and high return on investment.

Whether you’ve purchased a hurricane damaged home or you’re in the process of investing, we here at The Listing Real Estate Management can help! If you’re looking to turn your investment into a passive income earning rental property, we’ve got you covered with our full-service property management. We’ve helped hundreds of property owners optimize their income and financial returns with our proven and proactive strategies. To learn more, contact us today at The Listing Real Estate Management, your boutique property manager!

Copyright © 2017-2025, The Listing Real Estate Management. All Rights Reserved.